There have been many schemes to avoid paying taxes. The IRS has, for years, included these schemes and the related frivolous arguments as part of its Dirty Dozen list, reminding taxpayers “that time and again, these arguments have been thrown out of court.” The U.S. Tax Court recently heard yet another case focusing on such an argument–and ruled against it.

Background

Petitioner was self-employed as a gold and silver broker, published monthly newsletters about the gold and silver market, and provided brokerage services for clients. He conducted his business through two sole proprietorships, Moneychanger and Franklin Sanders, SP. According to court documents, the petitioner started his businesses in Arkansas but “fled the state” after an adverse state sales tax decision. He now lives in Tennessee.

In 1998 petitioner sold both entities to Little Mountain Corp, or LMC. After the sale, he provided consulting services to LMC through another sole proprietorship, Always Frank Consulting, or AFC. According to court documents, from 2009 and 2016, the petitioner submitted invoices, most of which were valued at over $10,000. Petitioner instructed LMC–which paid the invoices in checks made out to “cash”–to split the payments into installments of less than $10,000. Petitioner also received bonuses.

Examination

Petitioner did not file income tax returns for tax years 2008 through 2018, nor did he make estimated tax payments. After the IRS notified the petitioner that he was under examination, the IRS claims he failed to communicate with the revenue agent and did not attend the initial meeting. He also failed to comply with document requests for his business records, allegedly because he had no records.

Eventually, the IRS established that the petitioner received $3,492,526 in the years at issue. The IRS prepared substitutes for returns and issued a notice of deficiency. The petitioner responded by filing in Tax Court.

Arguments

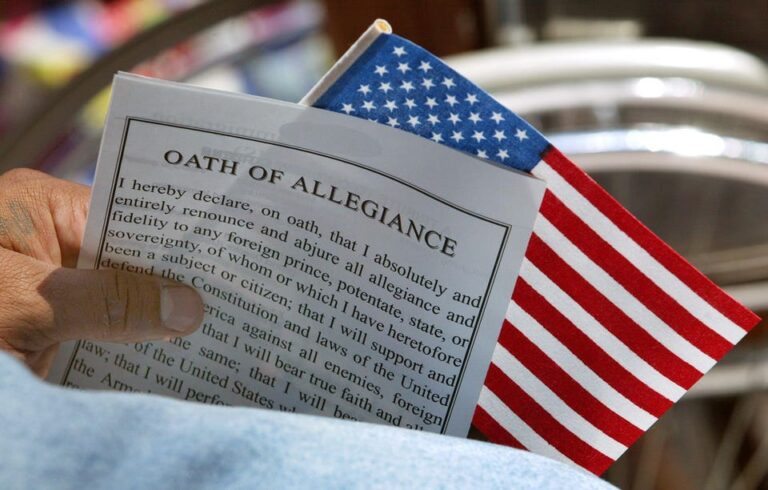

At Court, the petitioner argued that the payments he received from LMC are not taxable because he is not an “individual” subject to tax. Specifically, according to court documents, the petitioner claimed that he is a “citizen,” not an “individual.”

Petitioner relied on section 7701(a)(1) for this argument, which, among other things, defines a person “to mean and include an individual, a trust, estate, partnership, association, company or corporation” and references the term “citizen” throughout.

This, argued petitioner, is significant. Since “citizen” and “person” are listed together in various code sections, he claimed, the two are mutually exclusive as “citizen” and “individual.” That, he reasoned, means that he doesn’t have to pay taxes.

The Court noted that the petitioner’s theory that citizens do not need to pay federal income tax has been consistently rejected as frivolous. Additionally, the Court pointed to the Regulations at 1-1(a), which define an individual subject to tax as any “individual who is a citizen or resident of the United States.” A citizen is defined as “[e]very person born or naturalized in the United States and subject to its jurisdiction.”

In addition to the assessed tax, the IRS added penalties for failure to file, fraudulent failure to file, failure to pay, and failure to pay estimated tax.

Fraud

The burden falls to the IRS to prove fraud by clear and convincing evidence whenever there are fraud allegations. They must show “the taxpayer intended to evade taxes known to be owing by conduct intended to conceal, mislead or otherwise prevent the collection of taxes.”

The Court looked at many of what they call badges of fraud to determine fraudulent intent:

Failure to file tax returns.

Failure to report income over an extended period.

Failure to furnish the Commissioner with access to records or to cooperate with taxing authorities.

Failure to keep adequate books and records.

Experience and knowledge, especially knowledge of tax laws.

Concealment of bank accounts or assets from IRS agents.

Willingness to defraud another in a business transaction.

Implausible or inconsistent explanations of behavior.

Failure to make estimated tax payments.

A pattern of behavior that indicates an intent to mislead.

After a thorough review of the record, the Court concluded that at least eight badges of fraud demonstrate that the petitioner acted with fraudulent intent.

The petitioner raised several defenses to the other allegations, including that the Department of the Treasury failed to describe where the public can “make submittals.” The Court rejected each of those defenses.

Frivolous Argument

The petitioner did get a win: Section 6673(a)(1) authorizes a penalty of up to $25,000 whenever the taxpayer’s position appears frivolous or groundless. A taxpayer’s position is frivolous or groundless “if it is contrary to established law and unsupported by a reasoned, colorable argument for a change in the law.” The Court did find the petitioner’s arguments to be frivolous–and he repeatedly asserted these arguments in the pretrial period. However, since the petitioner did not pursue those arguments at trial, the Court did not impose a section 6673 penalty.

The case is Claude Franklins Sanders v. Commissioner of Internal Revenue, T.C. Memo. 2023-71.

Read More There have been many schemes to avoid paying taxes. The Tax Court rejected another one in a recent case.