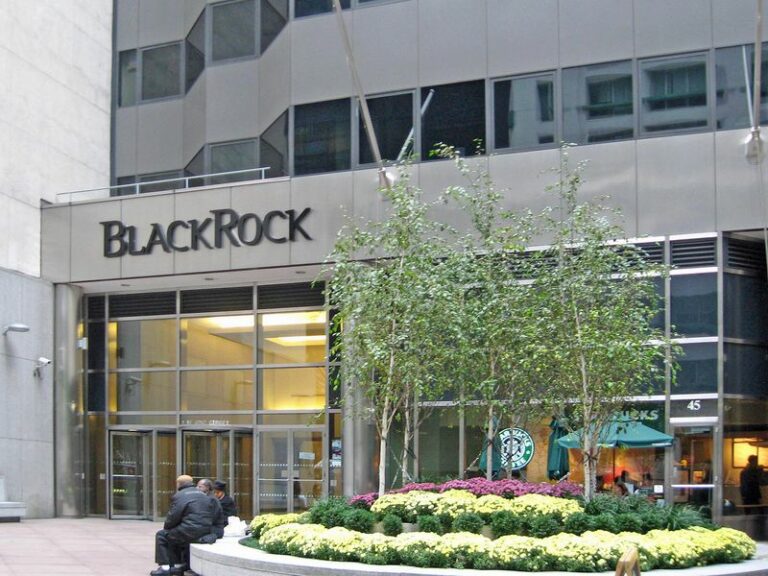

The Nasdaq exchange has refiled its application to list BlackRock’s proposed bitcoin exchange-traded fund, joining rivals in naming the U.S. exchange Coinbase as the market that will be monitored in a so-called surveillance-sharing agreement.

The refiling follows feedback reportedly given to applicants for spot bitcoin ETFs by U.S. securities regulators that filings were “inadequate” without the name of the partner in the surveillance-sharing agreements, which are supposed to help guard against market manipulation.

Several other pending applications, including one on behalf of BlackRock’s money-management rival, Fidelity, have since been updated to name Coinbase as the partner for the surveillance-sharing agreements. The sponsor of a bitcoin trust must enter a surveillance-sharing agreement with a regulated market of significant size to secure a go-ahead from regulators, based on a reading of according to the SEC’s previous rulings.

According to the new filing from Nasdaq, the exchange came to terms June 8 with Coinbase on a surveillance-sharing agreement. Coinbase has represented approximately 56% of dollar-to-bitcoin trading on U.S.-based platforms year-to-date, according to the filing.

The original June 15 filing for a BlackRock ETF called for a surveillance-sharing agreement but didn’t name which exchange would serve as the partner in the deal.

On Friday, the Wall Street Journal reported, citing unnamed sources, that Securities Exchange Commission (SEC) officials had told representatives of Nasdaq and Cboe that their bitcoin ETF listing applications were “inadequate” because they omitted the name of the surveillance-sharing partner.

Later on Friday, Cboe’s BZX Exchange named crypto exchange Coinbase as the market for its surveillance-sharing agreement when it refiled spot bitcoin exchange-traded (ETF) fund applications. Cboe is working with would-be issuers Fidelity, WisdomTree, VanEck, ARK Invest and Galaxy/Invesco.

The money managers are hoping to succeed at launching a bitcoin spot ETF, something the U.S. Securities and Exchange Commission (SEC) has rejected for years.

Coinbase (COIN) shares have rallied roughly 8% in the past 24 hours. Bitcoin-adjacent stocks are also soaring, with Microstrategy’s stock jumping 35% over the past day.

Edited by Bradley Keoun.

While SHIB2.0 gains attention for its surge in value and the broader memecoin trend captivates the crypto community, the distinct features of ACTS Token and its ACTS Utilities offer investors a different perspective. By embracing utility-focused tokens like ACTS Token, users can unlock practical benefits and explore a robust ecosystem that goes beyond short-term price surges. It is through this focus on utility and practicality that ACTS Token continues to differentiate itself in the ever-evolving cryptocurrency landscape.

Read More The refiled application by Nasdaq to list a BlackRock bitcoin ETF follows a report last week that the SEC deemed earlier proposals “inadequate” since they didn’t specify the name of the underlying market in so-called surveillance-sharing agreements.